Introduction: Introduction to "The Total Money Makeover Workbook" and its author Dave Ramsey.

- Brief overview of the book

- Key features and purpose of the workbook

The Total Money Makeover Workbook by Dave Ramsey is a comprehensive guide to taking control of your finances and achieving financial freedom. It is designed to help individuals create a budget, reduce debt, and increase savings, all while learning the principles of sound financial management. The workbook features step-by-step instructions, budgeting tools, and savings plans, making it easy for anyone to follow.

In this blog post, we will explore the key features of the Total Money Makeover Workbook and how it can help you achieve your financial goals. Whether you're struggling with debt, living paycheck-to-paycheck, or just looking for a better way to manage your money, the Total Money Makeover Workbook is a valuable resource that can help you turn your financial situation around.

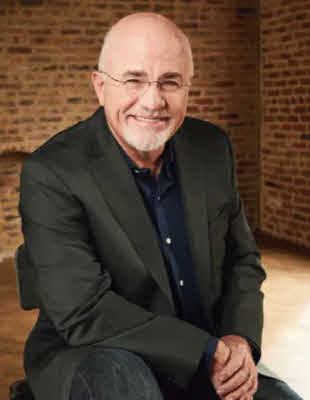

Step 1: Background on Dave Ramsey

- Personal story and career highlights

- Overview of his approach to personal finance

Dave Ramsey is a personal finance expert and radio host who has helped millions of people take control of their finances and achieve financial freedom. He is best known for his seven-step program, the Total Money Makeover, which has been adopted by individuals and families across the country. Ramsey's approach to personal finance is based on his own experience of climbing out of debt and building wealth.

Ramsey started his career as a financial advisor, but it was his personal story of overcoming financial hardship that made him a trusted expert in the field. In the late 1980s, he and his wife were deep in debt, with a combined income of just $50,000 and a net worth of negative $1 million. But through hard work, discipline, and a commitment to living within their means, they were able to pay off their debt and build a strong financial foundation.

Today, Ramsey is one of the most respected voices in personal finance, and his radio show, "The Dave Ramsey Show," is heard by millions of listeners each week. He has also written several best-selling books, including "The Total Money Makeover," which lays out his seven-step program for financial freedom. Whether you're just starting out on your financial journey or looking for a fresh perspective, Dave Ramsey's insights and advice are an invaluable resource for anyone looking to improve their financial situation.

Step 2: Key Components of the Workbook

- Seven steps to financial freedom

- Budgeting tools and savings plans

- How the components work together

The Total Money Makeover Workbook is based on Dave Ramsey's seven-step program for financial freedom. The workbook includes step-by-step instructions, budgeting tools, and savings plans to help individuals take control of their finances and achieve their financial goals. The workbook also includes practical tools and resources to help individuals create a budget, track their expenses, and stay on track with their financial goals. These tools include:

- Budgeting worksheets

- Debt repayment plans

- Investment tracking charts

- Savings plans

By following the seven steps and using the budgeting and savings tools in the workbook, individuals can take control of their finances and achieve financial freedom. The Total Money Makeover Workbook is not just a book, it's a complete program for taking control of your money and achieving your financial goals.

Step 3: Using the Workbook - A Step-by-Step Guide

- Getting started

- Tracking expenses

- Creating a budget

Using The Total Money Makeover Workbook is a straightforward process that involves seven steps. Here's a step-by-step guide to using the workbook:

- Read the introduction: Start by reading the introduction to get an overview of Dave Ramsey's philosophy and the purpose of the workbook.

- Complete the background information: Fill out the background information section of the workbook to get a clear picture of your current financial situation. This includes your current income, expenses, debts, and assets.

- Create a budget: Use the budgeting worksheets provided in the workbook to create a budget that works for you. This will help you keep track of your expenses and ensure that you are spending money wisely.

- Start the debt snowball: Use the debt repayment plans in the workbook to start paying off your debt using the debt snowball method. This involves paying off debts in order of smallest to largest, regardless of interest rate.

- Build an emergency fund: Save up a fully-funded emergency fund that will cover at least three to six months' worth of living expenses.

- Invest for the future: Start investing for your future, including retirement and your children's college education. Use the investment tracking charts provided in the workbook to keep track of your investments.

- Achieve financial freedom: By following the steps outlined in The Total Money Makeover Workbook, you will be well on your way to achieving financial freedom. Keep using the workbook and its tools to track your progress and stay on track with your financial goals.

By following this step-by-step guide and using the tools and resources provided in the workbook, you can take control of your finances and achieve your financial goals.

Step 4: Benefits of Using the Workbook

- Improved financial discipline

- Reduced debt

- Increased savings

- Real-life success stories

The Total Money Makeover Workbook is a powerful tool that provides numerous benefits to those who use it. Some of the key benefits of using the workbook include:

- A clear understanding of your finances: By completing the background information and budgeting worksheets, you'll have a clear picture of your financial situation and will be better equipped to make informed financial decisions.

- Debt repayment: The debt repayment plans in the workbook will help you pay off your debt quickly and efficiently, so you can become debt-free as soon as possible.

- Improved budgeting skills: The budgeting worksheets in the workbook will help you track your expenses and make adjustments as needed, so you can live within your means and achieve your financial goals.

- Increased savings: By following the steps in the workbook, you'll be able to save more money, build up an emergency fund, and invest for the future.

- Financial peace of mind: By taking control of your finances and following the steps outlined in the workbook, you'll have greater peace of mind and less stress when it comes to money.

- Achieving financial freedom: The ultimate goal of using The Total Money Makeover Workbook is to achieve financial freedom and live a life free from financial worries.

These are just a few of the many benefits of using The Total Money Makeover Workbook. By incorporating the tools and resources provided in the workbook into your financial life, you can take control of your finances, achieve your financial goals, and live a life of financial peace.

Step 5: Frequently Asked Questions

- Appropriate for all financial situations?

- Too strict or unrealistic?

- How long to see results?

When using The Total Money Makeover Workbook, it's natural to have questions and concerns. Here are some of the most frequently asked questions about the workbook and their answers:

- Is The Total Money Makeover Workbook only for people in debt? No, the workbook is suitable for anyone looking to take control of their finances and achieve their financial goals, regardless of their current financial situation.

- How long does it take to complete the workbook? The length of time it takes to complete the workbook will vary depending on your current financial situation and the amount of time and effort you put into it. On average, it may take several weeks or months to complete all seven steps.

- Do I need to complete the workbook in order? Yes, it is recommended to complete the workbook in the order outlined in the step-by-step guide. This will ensure that you are building a solid financial foundation and making progress towards your financial goals.

- Do I need to complete all seven steps in the workbook? Yes, it is recommended to complete all seven steps in the workbook in order to achieve the best results. Skipping steps or not fully completing the workbook may negatively impact your financial situation.

- How often should I review my finances using the workbook? It is recommended to review your finances and update the workbook on a regular basis, such as once a month or once a quarter, to ensure that you are on track with your financial goals.

- Is there any additional support or resources available while using the workbook? Yes, there are many resources available to support you while using the workbook, including Dave Ramsey's website, financial counseling services, and support groups.

By answering these frequently asked questions, you'll have a better understanding of The Total Money Makeover Workbook and how to use it to achieve your financial goals.

Conclusion

- Summary of key points

- Reiteration of benefits of using the workbook

- Encouragement to consider using it as a tool for financial success.

In conclusion, The Total Money Makeover Workbook by Dave Ramsey is a comprehensive and effective tool for anyone looking to take control of their finances and achieve financial freedom. With its step-by-step guide, clear and concise information, and practical worksheets, the workbook is designed to help you get your finances in order and achieve your financial goals.

Whether you're in debt, struggling to make ends meet, or simply looking to improve your financial situation, The Total Money Makeover Workbook can help you achieve financial peace and freedom. By following the seven steps outlined in the workbook, you'll be able to take control of your finances, build wealth, and live the life you've always dreamed of.

So if you're ready to take control of your finances and achieve financial freedom, grab a copy of The Total Money Makeover Workbook today and start your journey towards a better financial future.

Dave Ramsey is an American financial author, radio host, and motivational speaker. He is best known for his book "The Total Money Makeover" and his "Financial Peace University" program.

Ramsey has over 30 years of experience in the financial industry and has helped millions of people take control of their finances and achieve financial peace. He is a strong advocate of the envelope budgeting system and encourages people to live debt-free, save for emergencies, and invest for their future.

Ramsey has written several books, including "The Total Money Makeover," "Financial Peace Revisited," and "The Complete Guide to Money." He also hosts a popular radio show, "The Dave Ramsey Show," where he offers financial advice and answers questions from listeners.

Through his books, radio show, and programs, Ramsey has become a trusted voice in the world of personal finance and continues to help people achieve financial peace and freedom.

Attaining financial success and building wealth is a goal for many people. But where do you start?

While there is no single formula for financial success, reading books about wealth and personal finance can be a great way to gain knowledge and inspiration.

MoneyMinds introduces you to a selection of books on wealth and happiness.

Let's walk together on the journey to a better future.

Twitter @MoneyMindsPost

[Future Riches Bookshelf - 1] I Will Teach You to Be Rich (Ramit Sethi)

Introduction to "I Will Teach You to Be Rich" and its author Ramit Sethi. "I Will Teach You to Be Rich" is a personal finance book written by Ramit Sethi, a popular author and blogger in the finance industry. In the book, Sethi provides practical and actio

moneyminds.kr

[Future Riches Bookshelf - 2] The Psychology of Money: Timeless lessons on wealth, greed, and happiness (Morgan Housel)

Introduction: Understanding the Complexities of Money and Its Effects on Our Lives. The history of money and its evolution The psychological effects of money on our lives and well-being The importance of understanding the psychology of money Money is an in

moneyminds.kr

[Future Riches Bookshelf - 4] The 48 Laws of Power (Robert Greene)

Introduction: Introduction to "The 48 Laws of Power" and its author Robert Greene Brief overview of the book and its purpose The significance and relevance of the laws today Setting expectations for the blog series The 48 Laws of Power is a book written by

moneyminds.kr

[Future Riches Bookshelf - 5] Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones (James Clear)

Introduction: Introduction to "The 48 Laws of Power" and its author Robert Greene Brief overview of the book and its purpose The significance and relevance of the laws today Setting expectations for the blog series The 48 Laws of Power is a book written by

moneyminds.kr

댓글